The Highs and Lows: Gambling Winnings Tax

- Gambling Winnings Tax Rules 2019

- Gambling Winnings Tax Rules For Real

- Tax Rules For Gambling Winnings

- Gambling Winnings Tax Rules Irs

- Gambling Winnings Tax Rules Explained

There is a huge disparity in the quantity of tax collected across legal gambling jurisdictions. In some countries, punters can expect to lose up to 10% of their winnings to the taxman, whereas in other countries this can be between 1-3%. The method of collection varies greatly too, in some countries gambling taxes are collected with stealth and being not directly levied on the winnings, but propagated throughout the platform through various financial engineering methods. Adjusting payout rates is an efficient method for operators in the UK to collect taxes and avoid charging the winnings of customers. The end result is always the same no matter which method is applied, taxes are unavoidable. All we can do as a player at casinos, online gambling platforms, or sportsbooks is to continue to monitor the global markets, picking countries to play that offer the most favorable set of taxation laws for gambling customers.

Top Countries for Low Gambling Taxes

There is a huge financial incentive for countries to maintain a low rate of taxation on gambling Free slots for ipad mini. , the warmest and welcoming countries to new casinos enjoy huge shares of the profits through indirect means. Gamblers also gain financially. With the gambling winnings tax rate at the countries with the lowest taxes on casino winnings offering players the best deals, international gamblers will intentionally target these locations for huge portions of their play. Of course, the differences are sometimes not so large, and the material differences are only truly felt once you begin betting large sums of money. Below we'll go into more details on the top countries for low gambling taxes.

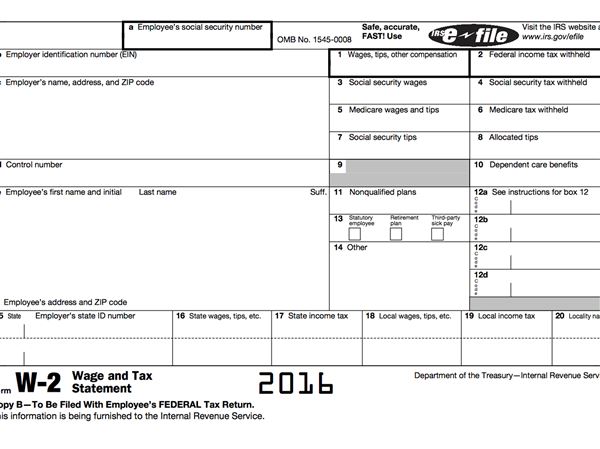

Reporting Tax on Winnings Taxes on Prize Money and Sweepstakes Winnings. Typically, tax on winnings, like sweepstakes or prize money, should be reported to you in Box 3 (other income) of IRS Form 1099-MISC. This includes winnings from sweepstakes when you did not make an effort to enter and also applies to merchandise won from a game show.

Russia

Of all the countries around the world with low taxes levied against gambling, Russia is the most welcoming of all. The Russian government collects 0% on Gross Gaming Revenue (GGR) from operators. Instead, the operators simply have to pay a monthly fee based on the number of gaming terminals, tables, and machines they have within the premises. This method results in a much lower taxation liability for the gambling operators and casinos in Russia, and this favorable set of circumstances is passed down to the customers in the form of much higher payout rates and better returns across the entire suite of gambling products.

However, the laws in Russia are constantly changing and there has been a bill introduced in late 2018 that has the potential to rock the gambling industry in Russia. A new flat tax will be applied to customers making wins over $200, and there has even been talked of doubling the monthly fee rate applied to casinos depending on their gaming capacity. All of these changes are being delicately considered by the government, and consideration is being made towards their effect on foreign investment. In Russia's far east, ambitious plans for Vladivostok gambling are already in motion to build an enormous casino hub on the scale of Las Vegas, all of which are dependent on foreign investors who are price-sensitive to Russia's gambling tax laws.

- Do Gambling Winnings Tax Rules in Canada Vary From Region to Region? The provinces and territories have different gambling laws. However, the tax rules for gambling winnings are the same across Canada. Professional gamblers must pay tax on their winnings while recreational players are entirely exempt. What a country to live in! You might also like.

- Whether it's $5 or $5,000, from an office pool or from a casino, all gambling winnings must be reported on your tax return as 'other income' on Schedule 1 (Form 1040), line 8. If you win a non-cash.

- The laws and taxes in online gambling is different from country to country. In this guide we'll try to get around as many gambling laws and taxes we can find. This means you can find out whether or not you have to pay gambling tax on your winnings, and also get to know more about the laws that the casinos have to follow.

- Gambling winnings, just like any other income, are taxed in the United States. If you raked in gold last year for sports betting, keep reading. In this post, we discuss everything you need to know about paying tax on sports betting.

Italy

Italy has a long and fabled history with gambling, and their culture of wagering goes all the way back to the pre-historic times at the birth of the Roman Empire. Citizens of the great Roman dynasty would often play games with dice and other gambling instruments. The oldest casino in the world opened in Venice in 1638, and since then the country has been a welcoming home of gamblers. Since then the industry has rapidly expanded to include a whole range of different gaming options, from traditional land-based casino venues to online gaming operators and sportsbooks. Italy now has some of the most liberal laws towards gambling in the world.

The Italian betting tax is one of the lowest levied across the legal gambling world. Most casinos pay 0% on Gross Gaming Revenue, and in a similar situation to Russia, they pay only on the capacity of their casino offerings. Customers who play at these locations enjoy the financial benefits too, and there is very few places in the world where players can get higher value for money on their winnings and book value payout rates than in Italy.

United States

The United States has a complicated relationship with gambling, primarily due to its legal code and system whereby states are able to draw up their own laws and taxes. The Federal Government has legalized many forms of gambling throughout the United States, and they set a low baseline tax rate of around 3%. Besides this, states where gambling is legal levy their own taxes, these can vary from between 2-5% in most jurisdictions. Accounting for both the Federal and State taxes, players can enjoy a relatively low tax on their winnings of around 5% in some parts of the country.

Whilst these rates do seem particularly low, there is a huge variation across some of the states so be careful if you're planning a trip. For the lowest gambling taxes in the United States, you'll want to head to either Nevada, New Jersey or South Dakota. Good news for Las Vegas enthusiasts as the Sin City is subject to a relatively low tax rate compared to the rest of the country. Gambling in the United States comes with a whole host of additional amnesties and luxury extras that you won't find elsewhere around the world, and overall it can be considered one of the best countries in the world to gamble.

Countries with High Gambling Taxes

Whilst there are several places a thrifty gambler would enjoy due to lowered levied tax on winnings, equally countries with high gambling taxes are worth being aware of and avoiding at all costs. The following three countries have been picked out for their especially high Gross Gaming Revenue (GGR) tax rates, meaning your net profits will be seriously affected whenever playing in these jurisdictions.

Germany

German gambling has been fully legalized for a long time and citizens can enjoy a whole host of gaming options both in-person and online. The country is packed full of casinos, poker rooms, and bookmakers, with large budgets allocated to marketing and the development of new gaming technologies across the country. For all these reasons many people in Germany gamble, but unfortunately, the tax code is harsh towards the industry in Germany, and customers here are usually getting prices far below the average market rate.

Gross Gaming Revenue (GGR) taxes can be as high as 90% on some casino operators. But in reality, it is much lower. Even so, the high GGR rate ensures that casino profits are shaved down to a very fine margin. All of this additional liability is passed on to the customers who have to pay a percentage of their winnings in taxes. At most online sports betting sites in Germany, the bet slips will display the gross winnings, to calculate the net you can usually discount at least 5% from this total amount on each bet.

United Kingdom

Perhaps the country with the most intimate relationship with gambling in the world, the British have a highly liberal and celebrated approach towards the gambling industry. Even the great Winston Churchill loved gambling, and would often go deep into the night playing cards and plotting his war strategies with his top generals. Whilst the market is becoming over-saturated with new operators, the government continues to collect enormous taxes from them.

Gambling operators based in the United Kingdom can pay up to 50% on Gross Gaming Revenue, but in reality, this is much lower. Home to some of the largest and richest gambling operators in the world, the British punters have an excellent range of choices when it comes to online casinos and sports betting. This huge plethora of online gaming options usually allow for top value to be found.

Macau

Gambling Winnings Tax Rules 2019

Asia has several gambling hotspots, but none amongst them are as popular as the high-roller hotbed in Macau. The coastal city that operators with economic freedom is the only legal place to gamble in China. The Chinese government was only willing to make this concession if the rewards would be plentiful, and indeed the gambling industry in Macau generates huge tax income for the Chinese state.

The highly lucrative business has a tax liability of up to 39% on Gross Gaming Revenue. With massive revenues flowing through their accounts, Macau is one of the richest and most capital intensive gambling industries throughout the world. Most punters are willing to make this trade-off between lower returns and a luxury trip to the glitz and glamour of Macau.

Gambling Winnings Tax Rules For Real

Go High or Go Low?

- Do Gambling Winnings Tax Rules in Canada Vary From Region to Region? The provinces and territories have different gambling laws. However, the tax rules for gambling winnings are the same across Canada. Professional gamblers must pay tax on their winnings while recreational players are entirely exempt. What a country to live in! You might also like.

- Whether it's $5 or $5,000, from an office pool or from a casino, all gambling winnings must be reported on your tax return as 'other income' on Schedule 1 (Form 1040), line 8. If you win a non-cash.

- The laws and taxes in online gambling is different from country to country. In this guide we'll try to get around as many gambling laws and taxes we can find. This means you can find out whether or not you have to pay gambling tax on your winnings, and also get to know more about the laws that the casinos have to follow.

- Gambling winnings, just like any other income, are taxed in the United States. If you raked in gold last year for sports betting, keep reading. In this post, we discuss everything you need to know about paying tax on sports betting.

Italy

Italy has a long and fabled history with gambling, and their culture of wagering goes all the way back to the pre-historic times at the birth of the Roman Empire. Citizens of the great Roman dynasty would often play games with dice and other gambling instruments. The oldest casino in the world opened in Venice in 1638, and since then the country has been a welcoming home of gamblers. Since then the industry has rapidly expanded to include a whole range of different gaming options, from traditional land-based casino venues to online gaming operators and sportsbooks. Italy now has some of the most liberal laws towards gambling in the world.

The Italian betting tax is one of the lowest levied across the legal gambling world. Most casinos pay 0% on Gross Gaming Revenue, and in a similar situation to Russia, they pay only on the capacity of their casino offerings. Customers who play at these locations enjoy the financial benefits too, and there is very few places in the world where players can get higher value for money on their winnings and book value payout rates than in Italy.

United States

The United States has a complicated relationship with gambling, primarily due to its legal code and system whereby states are able to draw up their own laws and taxes. The Federal Government has legalized many forms of gambling throughout the United States, and they set a low baseline tax rate of around 3%. Besides this, states where gambling is legal levy their own taxes, these can vary from between 2-5% in most jurisdictions. Accounting for both the Federal and State taxes, players can enjoy a relatively low tax on their winnings of around 5% in some parts of the country.

Whilst these rates do seem particularly low, there is a huge variation across some of the states so be careful if you're planning a trip. For the lowest gambling taxes in the United States, you'll want to head to either Nevada, New Jersey or South Dakota. Good news for Las Vegas enthusiasts as the Sin City is subject to a relatively low tax rate compared to the rest of the country. Gambling in the United States comes with a whole host of additional amnesties and luxury extras that you won't find elsewhere around the world, and overall it can be considered one of the best countries in the world to gamble.

Countries with High Gambling Taxes

Whilst there are several places a thrifty gambler would enjoy due to lowered levied tax on winnings, equally countries with high gambling taxes are worth being aware of and avoiding at all costs. The following three countries have been picked out for their especially high Gross Gaming Revenue (GGR) tax rates, meaning your net profits will be seriously affected whenever playing in these jurisdictions.

Germany

German gambling has been fully legalized for a long time and citizens can enjoy a whole host of gaming options both in-person and online. The country is packed full of casinos, poker rooms, and bookmakers, with large budgets allocated to marketing and the development of new gaming technologies across the country. For all these reasons many people in Germany gamble, but unfortunately, the tax code is harsh towards the industry in Germany, and customers here are usually getting prices far below the average market rate.

Gross Gaming Revenue (GGR) taxes can be as high as 90% on some casino operators. But in reality, it is much lower. Even so, the high GGR rate ensures that casino profits are shaved down to a very fine margin. All of this additional liability is passed on to the customers who have to pay a percentage of their winnings in taxes. At most online sports betting sites in Germany, the bet slips will display the gross winnings, to calculate the net you can usually discount at least 5% from this total amount on each bet.

United Kingdom

Perhaps the country with the most intimate relationship with gambling in the world, the British have a highly liberal and celebrated approach towards the gambling industry. Even the great Winston Churchill loved gambling, and would often go deep into the night playing cards and plotting his war strategies with his top generals. Whilst the market is becoming over-saturated with new operators, the government continues to collect enormous taxes from them.

Gambling operators based in the United Kingdom can pay up to 50% on Gross Gaming Revenue, but in reality, this is much lower. Home to some of the largest and richest gambling operators in the world, the British punters have an excellent range of choices when it comes to online casinos and sports betting. This huge plethora of online gaming options usually allow for top value to be found.

Macau

Gambling Winnings Tax Rules 2019

Asia has several gambling hotspots, but none amongst them are as popular as the high-roller hotbed in Macau. The coastal city that operators with economic freedom is the only legal place to gamble in China. The Chinese government was only willing to make this concession if the rewards would be plentiful, and indeed the gambling industry in Macau generates huge tax income for the Chinese state.

The highly lucrative business has a tax liability of up to 39% on Gross Gaming Revenue. With massive revenues flowing through their accounts, Macau is one of the richest and most capital intensive gambling industries throughout the world. Most punters are willing to make this trade-off between lower returns and a luxury trip to the glitz and glamour of Macau.

Gambling Winnings Tax Rules For Real

Go High or Go Low?

The question of whether to go high or low is difficult for most countries to contend with when designing their tax code. In order to attract foreign investment and drive growth it is better to start with lower taxes, and once a well-grounded gaming industry has been established, gradually increase the tax rate levied. This approach is being utilized across the world and is seeing governments enjoy huge revenues collected directly from the pockets of gamblers.

Frequently Asked Questions

Tax Rules For Gambling Winnings

What percentage is gambling winning tax?

This depends massively on where you live. If you are playing at online casinos in the UK, there is no gambling winning tax. But in the USA, the gambling winning tax can be above 20% in some states.

Gambling Winnings Tax Rules Irs

Do I need to declare all gambling winnings?

Gambling Winnings Tax Rules Explained

Just as with what amount gambling winning tax may be, whether or not you need to declare your winnings massively depends on where you live. If you play at real money sites in a country where you need to pay taxes on your winnings, then you need to declare them. Basically, if you need to pay taxes, you need to declare and pay.